Introduction Fintechzoom Apple Stock

Apple Inc. (AAPL) is one of the most influential companies in the technology sector, renowned for its innovative products and strong market presence. With its stock being a key focus for investors, Fintechzoom offers valuable insights and analysis on AAPL. This article explores Apple’s stock performance, key factors affecting its price, and how to use Fintechzoom’s resources for informed investment decisions.

Overview of Apple Inc.

1. Company Background

- Business Model: Overview of Apple’s operations, including its product lines (iPhone, iPad, Mac, Apple Watch, etc.) and services (App Store, Apple Music, iCloud).

- Market Position: Apple’s role in the technology industry and its competitive landscape.

2. Recent Developments

- Product Launches: Recent product releases and their impact on the market.

- Financial Performance: Key financial metrics, such as revenue, profit margins, and market capitalization.

Current Trends in AAPL Stock

1. Stock Performance

- Historical Performance: Analysis of Apple’s stock performance over the past year, highlighting significant price movements and milestones.

- Recent Trends: Examination of recent stock price movements, trading volume, and market reactions.

2. Influencing Factors

- Market Sentiment: How investor sentiment, news coverage, and social media discussions influence AAPL stock price.

- Economic Indicators: Effects of broader economic factors such as interest rates, inflation, and global economic conditions on Apple’s stock.

Fintechzoom’s Insights on AAPL Stock

1. Analytical Tools and Resources

- Price Charts: Interactive charts and historical data available on Fintechzoom for tracking AAPL stock.

- Expert Opinions: Analysis and predictions from financial experts and analysts featured on Fintechzoom.

2. Forecasts and Predictions

- Short-Term Forecasts: Predictions for AAPL stock price movements over the next few months based on current data.

- Long-Term Outlook: Analysis of potential long-term trends and factors that could impact Apple’s stock price.

Investment Strategies for AAPL Stock

1. Risk Management

- Volatility Considerations: Understanding the volatility of AAPL stock and strategies to manage risk.

- Diversification: Integrating AAPL stock into a diversified investment portfolio to mitigate risk.

2. Market Timing

- Buying and Selling: Identifying the best times to buy or sell AAPL stock based on market conditions and Fintechzoom’s analysis.

- Monitoring Trends: Utilizing Fintechzoom’s tools for real-time data and alerts to make well-informed investment decisions.

Practical Tips for Investors

1. Utilizing Fintechzoom

- Real-Time Data: Leveraging Fintechzoom’s real-time data, alerts, and notifications to stay updated on AAPL stock.

- Research and Analysis: Using Fintechzoom’s research reports and expert insights to guide investment decisions.

2. Staying Informed

- News and Updates: Keeping up with the latest news about Apple, including product launches, financial results, and market trends.

- Financial Reports: Regularly reviewing Apple’s quarterly earnings reports and other key financial documents.

Apple’s Historical Stock Performance

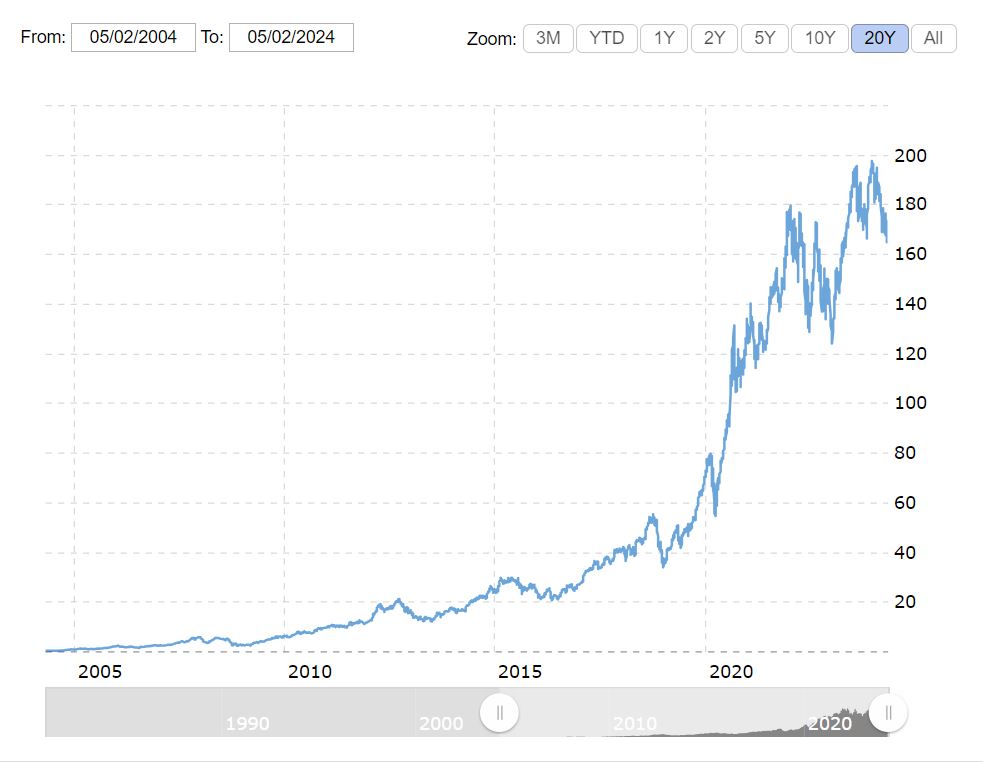

Over the decades, Apple’s historical stock performance has demonstrated a remarkable trajectory marked by consistent growth and resilience in the face of market fluctuations. The Fintechzoom apple stock analysis reveals a decade-long trend of upward movement, showcasing Apple’s ability to weather market volatility.

Apple’s stock has been a notable performer, reflecting the company’s innovative products and strong financials. The consistent growth in Apple’s stock price has been influenced by various factors, including successful product launches, robust sales figures, and strategic business decisions.

Investors tracking Fintechzoom apple stock have witnessed the impact of Apple’s historical performance on market sentiment and investor confidence. The detailed earnings reports coverage has provided insights into the company’s financial health and future prospects, contributing to the overall positive trajectory of Apple’s stock.

As Apple continues to evolve and expand its product offerings and services, the historical stock performance serves as a confirmation to the company’s ability to deliver value to its shareholders amidst changing market dynamics.

Analyst Ratings and Target Prices

Continuing to assess Apple’s performance beyond historical trends, the current focus shifts towards analyzing Analyst Ratings and Target Prices for AAPL stock. Analyst Ratings play a vital role in guiding investors by providing insights into the potential future performance of a stock.

These ratings are often based on in-depth analysis of various factors, including company financials, market trends, and industry competition. Additionally, Target Prices offer a specific price level at which analysts believe the stock is fairly valued or should be traded in the future. Investors frequently consider these target prices when making decisions about buying, selling, or holding a stock like Apple.

Fintechzoom‘s apple stock price prediction section may contain a range of analyst ratings and corresponding target prices for AAPL stock. This data can be invaluable for investors seeking to make informed decisions based on expert opinions and market insights.

By incorporating these ratings and target prices into their investment strategies, individuals can better navigate the dynamic landscape of the stock market and potentially optimize their returns.

Decade-Long Stock Growth Analysis

Across the past decade, Apple’s stock has exhibited remarkable and sustained growth, reflecting the company’s consistent performance in the market. This growth can be attributed to several factors, including Apple’s ability to innovate and adapt to changing market conditions.

Despite facing challenges such as market volatility and competition, Apple has managed to maintain a steady upward trajectory in its stock value. The company’s focus on delivering high-quality products and services, coupled with its strong brand reputation, has contributed to investor confidence and loyalty over the years.

Other stock companies that want to stand firm in this market can also learn from Apple’s contribution to maintaining customer loyalty by providing high-quality products and services. For example, you can customize gifts for customers. Custom Pens is a good choice. Engrave the company’s logo and other information on the pen body, which not only improves customer satisfaction, but also increases brand awareness to a certain extent.

Furthermore, Apple’s strategic decisions, such as expanding into new markets and diversifying its product portfolio, have also played a significant role in driving stock growth. By consistently meeting or exceeding market expectations and demonstrating resilience in the face of economic uncertainties, Apple has established itself as a reliable investment option for many stakeholders. Moving forward, continued emphasis on innovation and customer-centric strategies will likely be key drivers of Apple’s stock growth in the years to come.

Impact of Product Launches

Amidst Apple’s sustained stock growth over the past decade, a pivotal factor influencing its market performance is the impact of new product launches on the company’s stock price. Apple’s stock price tends to react markedly to the introduction of new products, reflecting investor expectations and market sentiment surrounding these launches.

Historically, highly anticipated products like the iPhone, iPad, and Apple Watch have driven both consumer interest and investor confidence, leading to surges in stock value. Conversely, product launches that do not meet expectations or face challenges in the market can result in temporary dips in Apple’s stock price as investors reevaluate their positions.

Conclusion

Apple Inc. (AAPL) remains a prominent player in the technology sector with significant investment potential. Fintechzoom provides essential tools and insights to help investors understand and navigate Apple’s stock performance. By leveraging current trends, Fintechzoom’s analytical resources, and adopting strategic investment approaches, investors can make informed decisions regarding AAPL stock.